What You Need to Know About Your Credit Report and Credit Score!

When you're beginning to think about purchasing a new home one of the most important factors to understand is what you should know about your credit report and credit score.

It should be mandatory for all young people to learn the importance of good credit and how that can and will affect their future.

Developing good credit at a young age can make your life a lot easier as an adult.

If you're new to the game of credit and trying to establish credit for yourself there are a few different things you can to do to get yourself started.

First, you'll want to get yourself a credit card that you can make monthly payments on each and every month.

In doing so you are showing creditors that you can be trusted to borrow money and you'll be developing 'Credit History' which lenders look at before agreeing to approve you for things such as loans, mortgages and so on.

Second, you'll want to make sure that you make all of your payments on time each and every month. Whether it is a day care provider, cell phone company, or anything else; if your account is past due 30 days or goes to collections it will be reported to the credit bureau and can affect your credit.

Some items do not affect your credit score itself but will appear in your credit history if a lender looks into your credit which can affect their willingness to lend to you as you may be considered higher risk with each negative instance appearing on your credit report.

Lastly, always know what your credit score is and what is being reported on your credit report.

Items affecting your credit report will stay on your record for 6 - 7 years (or more) depending on which credit bureau they are listed on so you want to make sure the information is accurate. If there are discrepancies you will want to contact them immediately to clear things up. You'd hate to be penalized for something that shouldn't be on your file.

If you want to see how long an item will stay on your record you can click here.

In Canada there are two main Credit Bureaus that lenders look at when making an inquiry on your credit, Equifax and TransUnion. It's a good idea to request a copy of your credit report from each bureau to have a complete picture of your credit history and what is being shown to lenders when they run your credit report.

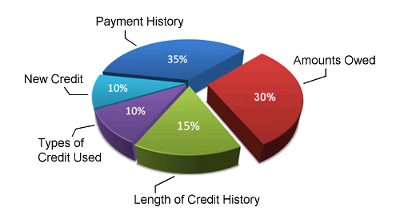

Although both bureaus keep their magic formula to compute your credit score a secret, here are the factors it is made up of.

1. Payment History

2. How Much is Owed (Debt)

3. Length of Credit History

4. New Credit Applications

5. Types of Credit Used

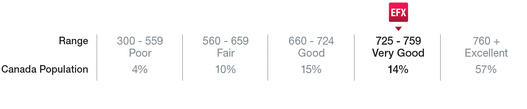

Your credit score is a three digit number ranging from 300 to 900 points, 900 being the highest or best score.

Here is a chart to show you where your score falls in:

(Note, the bolded item was from a sample on the Equifax website)

Although your credit score is looked at, your debt ratio and credit history are also considered by lenders when you apply for credit. If you do not have a fantastic credit score, that alone may not mean that you won't qualify.

It is smart to do what you can to improve your credit if it's low or to keep it in good standing if you have a good score.

Here are a few tips to improving your credit score:

1. Ensure all payments are paid on time

2. Keep your debt below 30% of the total debt limit

3. Use multiple sources of credit (i.e. credit card, line of credit, etc.)

4. Keep the number of inquiries (credit applications) on your account to a minimum

For more information on understanding your credit score and credit report, or for more tips on how to improve your credit score check out this great resource from the Financial Consumer Agency of Canada by clicking here.

To return from this What You Need to Know About Your Credit Report and Credit Score page to the Oakville Homes And Condos click here.

Click here to download a FREE digital copy of the real estate investing book, Income For Life for Canadians.

Downloaded by over 26,354 Canadians since 2007. Grab your copy by clicking here now.

The Rock Star Real Estate Team after a game of Trampoline Dodge Ball in Mississauga, Ontario.

You can contact anyone on our team by going to their profile pages by clicking here.